Home Depot Valuation in 2000 (BAV, Monday, Week 8)

business-analysis-and-valuationyear-twoHome Depot current performance (2000) versus past:

-- More stores (scale/efficiency gains), higher revenue per square foot, higher revenue per transaction (customer loyalty?)

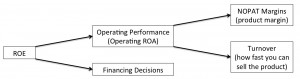

-- Higher NOPAT margins, but lower asset turnover => shift from leasing stores to ownership; "clustering" strategy in store expansion

-- Favorable macro environment

Growth plans:

-- "Design" stores => higher margin BUT lower turnover? more sensitive to business cycle? saturated market?

-- International geographic expansion => higher cost?

-- Internet/in-store pickup => lower COGS BUT less customer service (Home Depot value proposition)

-- Expansion to professionals and Buy-It-Yourself => huge markets, big transactions BUT more cyclical?

Key questions (hard to answer):

What is terminal sales growth?

What is correct market risk premium (in hindsight; this was mid-2000)?

What will long-term NOPAT margins be?

- Next: Rwanda (MOC, Monday, Week 8)

- Previous: eHarmony (CSN, Tuesday, Week 8)