Social Strategy at American Express (CSN, Monday, Week 13)

competing-with-social-networksyear-twoWhat does Amex do?

Card issue:

-- Aspirational/premium image (fees), higher spending per cardholder than competitors

-- Direct to consumer (no issuers) = CONTROL, "closed loop"

but CAC is higher than competitors ($250+)

Transaction processing:

-- Charge higher fees to merchants

-- First-mover into value-add services: travel planning, concierge => consumer perception of safety

but limited availability of merchants

Funding liabilities:

-- 8% loss provisions (disputed charges; non-payment)

And then they start getting into social...

Strengths of AmEx execution:

-- Willingness to experiment.

-- Evolve from mediocre initiatives (Members Project) to stuff that drives business results (Social Rewards Program). Develops in-house social proficiency; solves the "Legal needs three days to review every tweet" problems; continuous improvement.

-- Because CAC is ordinarily so high, lots of potential in social/network effects pay off handsomely.

-- Capitalizes on existing AmEx positioning/overall strategy (trustworthiness of brand means that consumers are more likely to link credit card to FourSquare account; premium image means that consumers are more likely to brag about AmEx deals/share with friends).

-- Ends up with AmEx thinking about their core business differently (potential to drive traffic to retailers; loosely competitive with Groupon/LivingSocial).

Challenges:

-- Still a big company.

-- Change takes time.

Takeaways:

(1) Usually, everybody's social strategy starts with taking your initial product and sprinkling in badly-designed social elements (make a Facebook page). Need to evolve from there.

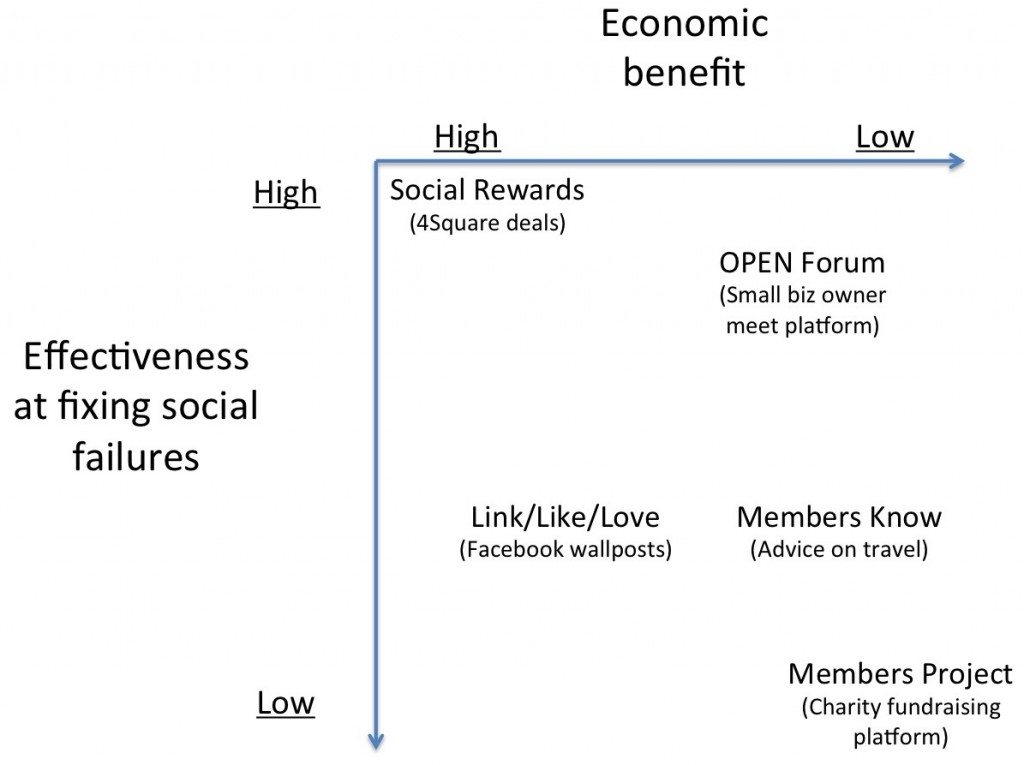

(2) Usually, there is some element of trade-off between fixing social failures and effectively monetizing. It's hard to find programs that (1) make a boatload of money and (2) offer awesome social solutions.